|

PRESS ANNOUNCEMENT |

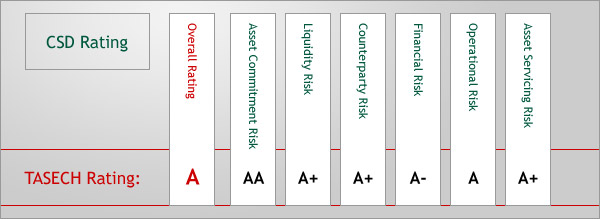

Thomas Murray Issues a Central Securities Depository Rating of 'A' for the Tel Aviv Stock Exchange Clearing House

LONDON - Thomas Murray, the specialist custody rating, risk management and research firm is pleased to announce the issue of a Public Depository Rating to The Tel Aviv Stock Exchange Clearing House (TASECH) of Israel. TASECH has been awarded a Public CSD rating of 'A', being a low overall risk rating made up of the following components:

The Tel Aviv Stock Exchange Clearing House is the sole clearing house and depository for all securities issued in Israel. TASECH is a wholly owned subsidiary of the Tel Aviv Stock Exchange (TASE) and shares many of its internal resources with the TASE. TASECH has its own Board of Directors, however, every decision of the Board of Directors of TASECH is subject to approval by the Board of Directors of TASE. The TASECH is supervised by the Israeli Securities Authority (ISA) pursuant to the Israeli Securities Law.

TASECH's rating of 'A' relates to a low risk exposure profile and a 'Stable' outlook has been assigned by Thomas Murray. The outlook indicates that the rating of 'A' is unlikely to change in the near future. However, TASECH has a number of projects in progress that will help to mitigate risk and potentially improve the rating in the future. Major among these is the plan to move both corporate bonds and equities to settle on a T 1 cycle in 2009, rather than the present TD settlement cycle.

1 cycle in 2009, rather than the present TD settlement cycle.

TASECH acts as central counterparty to all TASE and MTS Israel executed transactions. Their settlement guarantee is backed by a Risk Fund (~USD 330m) and an approach to fails management that is cooperative with market participants. DVP settlement is in central bank funds via a SWIFT link between TASECH and the Bank of Israel's ZAHAV RTGS payment system. All securities are immobilised within nominee companies, a decentralised approach to safekeeping which is market practice but differs from traditional CSD models. In respect of asset servicing, TASECH, through its close relationship with TASE, provides reliable, primary sourced event information. All corporate actions must be routed through TASE (by law) and cash entitlements are distributed in central bank funds through ZAHAV. In its operations, TASECH uses manual processes in some areas of its operations such as buy-ins and voluntary corporate actions, but most other core operations are highly automated which is reflected in its relatively low staff complement. Financial risk exposure has improved since TASECH became an individual subsidiary of TASE with its own capital in September 2006, and profits have been increasing in recent years. TASECH maintains sizeable insurance against potential claims made against it by participants. TASECH operates sophisticated and comprehensive Disaster Recovery and Business Continuity Plans utilising cluster communications and IT infrastructure as well as professionally managed alternative office facilities and resources.

Simon Thomas, CEO and Chief Ratings Officer of Thomas Murray said: "Thomas Murray is delighted to be able to announce the public rating of the Tel Aviv Stock Exchange Clearing House. TASECH plays a critical role in the Israeli capital market infrastructure, acting as both central counterparty and central securities depository, and the review determined TASECH's commitment to high service quality, prudent risk management and responsiveness to market needs. The current rating and review process should help support this commitment to quality."

Ester Levanon, CEO of the Tel Aviv Stock Exchange , said "TASECH is pleased to have worked with Thomas Murray in order to obtain an independent view of our existing capabilities and processes. The rating process involved a thorough review of TASECH's clearing and settlement process, and the 'A' rating demonstrates that TASECH is in an excellent position to support the Israeli capital market".

The Central Securities Depository rating assesses the performance of the CSD to mitigate risk in its activities of safekeeping and the clearing and settlement of securities, where applicable. It assesses six key risks. The methodology considers the capabilities of the depository and the quality and effectiveness of its operational infrastructure. It also assesses the depository's willingness and ability to protect its participants or clients from losses. As part of the rating, the scope and quality of the depository's services is assessed. The ratings are on a consistent global scale, using the familiar AAA to C ratings scale. Once the rating is assigned there is an ongoing surveillance process to monitor the depository.

Separately, Thomas Murray has maintained proprietary assessments of over 140 CSDs globally as part of the Thomas Murray Depository Risk Assessment services. These reports are available via the Thomas Murray on-line store at www.thomasmurray.com.

For further information contact:

|

Simon Thomas or John Woodhouse |

Ester Levanon |

About Thomas MurrayThomas Murray is a specialist custody rating, risk management and research firm specialising in the global securities services industry. Thomas Murray was established in 1994. The Company tracks and analyses over 250 custodians globally and monitors the risk of over 100 capital market infrastructures. The Company has a strong position as a provider of public and private ratings and risk assessments on global custodians, domestic custodian banks and capital market infrastructures. About Tel Aviv Stock Exchange Clearing HouseThe Tel Aviv Stock Exchange Clearing House Ltd. (TASECH) was established in 1966, and became a wholly owned TASE subsidiary in September 2006. TASECH clears all securities transactions executed on and off the stock exchange. TASECH also handles the creation and redemption of mutual fund units and custody of securities, jointly with the Nominee Companies. TASECH also carries out payments on behalf of companies: dividends, interest, benefits, exercise of convertibles, exercise of rights, etc. TASECH is a member of the Depository Trust and Clearing Company (DTCC) in the United States, the world’s largest clearing house, through which it provides clearing services to dual-listed equities. |

|

Registered office: Holbrook Court, Northumberland Road, Portsmouth, PO5 1DS. |

© Thomas Murray Ltd. 2008 |